Accounting is the cornerstone of any successful business. It’s the process of tracking, analyzing, and reporting your financial transactions. Although accounting can be complex and time-consuming, it’s essential to understanding your cash flow and making sound business decisions. In this blog post, we’ll discuss the basics of accounting that small businesses need to know.

THE THREE MAIN BRANCHES OF ACCOUNTING

Accounting can be broken down into three main branches – Financial Accounting, Managerial Accounting, and Tax Accounting. Each branch has its own objectives and uses different methods of recording and reporting financial transactions. Here’s an overview of each branch:

• Financial Accounting

The first type of accounting is financial accounting, which involves preparing financial statements for external users (such as investors, creditors, and tax agencies). With this branch of accounting, you’re responsible for tracking all transactions and generating reports based on those activities. These reports are typically presented in the form of income statements, balance sheets, and cash flow statements. Financial accounting also includes creating budgets and preparing taxes.

• Managerial Accounting

The second branch of accounting is managerial accounting. Unlike financial accounting, this branch focuses on providing internal users with information about their business operations. Managerial accountants create budgets and monitor expenses to ensure that managers are making informed decisions about how to best allocate resources. They also analyze data to identify trends or problems that could be addressed with more efficient management strategies. Additionally, managerial accountants produce cost-benefit analyses and other reports that help managers track performance metrics over time.

• Tax Accounting

Last but not least is tax accounting. This branch deals specifically with taxes and filing returns with various state and federal agencies. Tax accountants must stay up-to-date with changes in tax law so they can advise their clients on the best ways to minimize their liabilities while still complying with regulations. They also prepare returns for individuals or companies who owe taxes, as well as defense documents for those who are being audited by the IRS or other government entities.

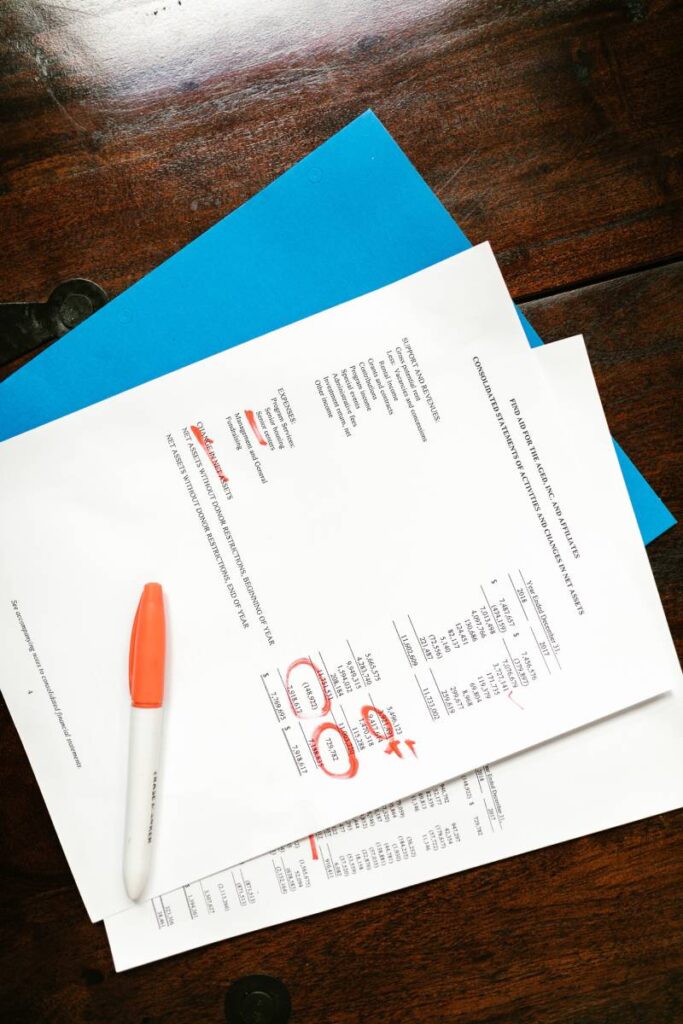

FINANCIAL STATEMENTS

Financial statements are used to track a company’s performance over a period of time (usually one year). These documents provide an accurate picture of how well the company is doing financially by showing its income, expenses, assets, liabilities, equity, etc. The main types of financial statements are balance sheets (assets vs liabilities), income statements (revenue vs expenses), cash flow statements (cash inflows/outflows), and statements of changes in equity (ownership). Knowing how to interpret these documents is essential for any small business owner who wants to understand their finances accurately.

Accounting may seem daunting at first glance but it doesn’t have to be overwhelming! By understanding the basics – from the three main branches to financial statement interpretation – you’ll be able to manage your finances more effectively and make better business decisions overall. Whether you outsource accounting services or handle them yourself in-house, having a solid grasp on these fundamentals will serve you well over time as you grow your small business!